“Problems are not stop signs; they are guidelines.” – Robert H. Schuller.

This quote holds true for the years 2019-2022. While 2022 showed signs of improvement compared to the early months and years of the COVID-19 pandemic, it still had its own setbacks, with the heart of this pandemic in China.

In 2022, every country began to resume from where they left off before the pandemic, with a focus on national development over excessive consumption.

As Sun Wu wisely said, “In the midst of chaos, there is also opportunity.”

The China forklift industry, while not experiencing a massive leap, achieved significant milestones, breaking records, and increasing productivity in certain aspects.

Let’s shine a brighter light on this journey…

In 2022, the forklift industry faced its fair share of challenges. There was a noticeable 4.68% decline in total sales volume (V) among domestic motor vehicle manufacturers, resulting in 1,047,967 units sold compared to 1,099,383 units in the previous year. It was indeed a tough year marked by a drop in sales.

However, amid these trials, there was a shining achievement. The industrial vehicle industry in China managed to reach the significant milestone of over one million units sold.

This accomplishment is truly remarkable and reflects the resilience and determination of the industry.

Despite the stress and hardships of the year, the forklift industry in China not only persevered but also reached an impressive milestone.

It’s a testament to the industry’s ability to adapt and maintain a commitment to excellence, even in the face of adversity.

Let’s examine various types of forklifts and compare their performance in 2022 to the previous year, 2021. Additionally, let’s explore the sales volume in both the domestic and export markets.

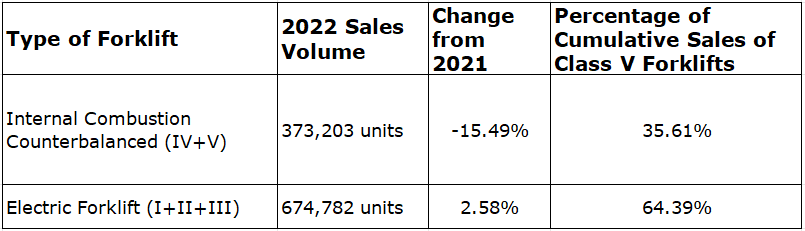

Table 1: Types of Forklifts and Sales Volumes (2022 vs. 2021)

In the table above, we can observe that the sales volume of Internal Combustion Counterbalance Forklifts (IV + V) experienced a 15.49% decrease in sales, totaling 373,203 units in 2022. This is in comparison to the previous year’s sales of 441,595 units, representing 35.61% of the cumulative sales of Class V Forklifts.

Conversely, Electric forklifts (I + II + III) saw a 2.58% increase in sales, reaching 674,782 units in 2022 compared to 657,787 units in 2021. This category accounts for 64.39% of the cumulative sales of Class V Forklifts

Table 2: Types of Forklifts in the Domestic/ Export Market (2022 vs. 2021)

In this table, we notice some notable shifts. While the export of Internal Combustion Counterbalance Forklifts (IV + V) surged by 17.07%, domestic sales of these forklifts saw a significant decline of 22.85%. Similarly, domestic sales of Electric forklifts (I + II + III) experienced a more modest decrease of 3.53%.

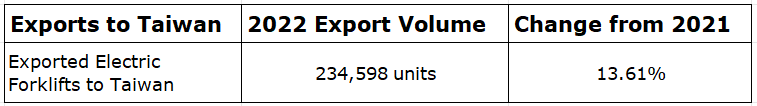

Table 3: Exports to Taiwan (2022 vs. 2021)

In the Export to Taiwan table, it’s evident that the sales of Electric forklifts experienced a substantial increase of 13.61%, totaling 234,598 units sold.

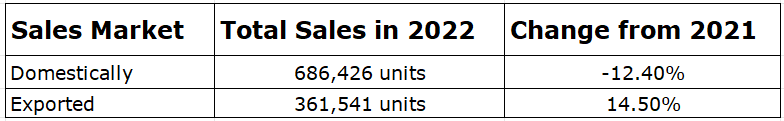

Table 4: Sales Market (Domestic and Exports) (2022 vs. 2021)

In this table, Export sales saw a notable increase of 14.50%, amounting to 361,541 units sold, compared to the previous year’s 315,763 units. Conversely, domestic sales witnessed a decrease of -12.40%, declining from 783,620 units in the prior year.

Therefore, Considering the sales volume of industrial vehicles in 2022:

- The leading two industrial vehicle models in China alone contribute to over 44% of the nation’s total sales.

- When we expand the scope to the top 10 industrial vehicle models, they collectively represent more than 77% of China’s total sales for 2022.

- Expanding even further, the top 20 industrial vehicle models account for over 89% of China’s total sales in 2022.

- Remarkably, if we look at the top 38 industrial vehicle models, they contribute to an impressive 94% of the nation’s total sales in 2022.

That is to say:

The Top 10 China Forklift Brands: A Glimpse at 2022 Achievements

Despite the challenges posed by the pandemic, Anhui Heli Co., Ltd and Hangcha Group Co., Ltd have once again proven their dominance as the top two forklift manufacturers in China in 2022, showcasing their enduring strength and global impact.

HELI

Heli, Anhui Heli Co., Ltd, is a powerhouse in the industry. Their core business spans R&D, manufacturing, and sales of industrial vehicles, logistics systems, and a range of after-market services, including re-manufacturing and vehicle leasing.

In the first three quarters of 2022, Heli experienced a 1.09% increase, reaching 11.949 billion Yuan, demonstrating their consistent growth and commitment to excellence.

Hangcha Group Co., Ltd. continues to thrive with a year-on-year sales increase of 3.28%, totaling 11.365 billion Yuan in 2022.

Their strategic focus on the “New Energy Strategy” underscores their dedication to scientific and technological innovation, driving them towards industry leadership in the research and development of intelligent new energy products.

In a year marked by adversity, China’s forklift industry continued to showcase its resilience and innovation. Among the top players, eight brands stood out with sales revenues surpassing RMB 1 billion.

- Linde, a part of the Kion group, boasts three decades of presence in China. Their commitment was further solidified with the completion their factory in Jinan, Shandong, in 2021. Linde accelerated the ‘smart’ manufacturing revolution, optimizing digital and automated products and services.

Despite not including Tailift’s sales, Toyota maintained its prominence, though its rank saw a slight decline, achieving sales totaling 6 billion yuan.

Jungheinrich brings nearly seventy years of expertise in intralogistics automatic warehousing to the table. Their Shanghai factory specializes in producing counterbalanced forklifts and reach forklifts.

Hyster‘s impressive sales figures encompassed Hystermax Forklift (Zhejiang) Co., Ltd., contributing to its year-end success.

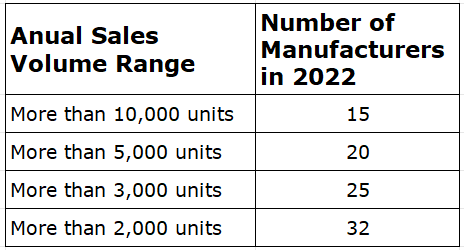

Furthermore, among the top twenty manufacturers, Mitsubishi, Tailift, Liugong, Kion Baoli, Xilin, Goodsense, and JAC have each sold over 10,000 units of forklifts.

The collective market share of domestic forklift brands surged past 80%, with Heli and Hangcha commanding a substantial 44%.

These industry leaders symbolize unwavering resilience and innovation, forging a path of significance in the global forklift market.

The Future of Forklifts: Embracing Innovation

The forklift industry is on the brink of a technological revolution, with artificial intelligence leading the way to a brighter future.

Over the past decade, China’s forklift sector has seen impressive growth. In 2022, electric forklifts took the lead, capturing a remarkable 64.39% market share. This shift is driven by market demand, energy conservation, and a thriving electric forklift industry.

China’s industrial vehicle industry is also exploring new power sources. In 2022, Heli and Hangcha introduced hydrogen fuel cell forklifts, paving the way for sustainable energy solutions.

The future promises exciting innovations in the forklift industry.

In Summary,

- Strong Sales in Challenging Times: Sales surpassed 1 million units in 2022, despite a 4.68% decline. The industrial vehicle industry adapted to market challenges, aided by robust demand, energy conservation, and innovation.

- Thriving Foreign Trade Exports: In 2022, foreign trade exports of forklifts grew by 14.50%, with 361,541 units exported. Companies, seeking new markets, turned to foreign trade, capitalizing on overseas opportunities and markets.

- Rise of New Energy Products: Electric forklifts increased by 2.58% in 2022, comprising 64.39% of Category V forklift sales. This shift reflects growing ecological awareness and support for green initiatives.

- Saturated Domestic Market: The domestic forklift market reached saturation in recent years. Sales declined due to overcapacity, reduced purchasing power, and market competition, leading to industry transformation.

- Independent Brands Flourish: Despite a slight overall sales decline, domestic independent brands flourished. Increased R&D investment, product diversification, and competitiveness improvements fueled their growth.

- Automation and Intelligent Logistics: As labor costs rise and efficiency demands increase, automation and intelligent logistics gain importance. The forklift industry is actively exploring these areas to improve productivity.

- Exploring New Energy Sources: The industry continues to explore new energy sources, from batteries to hydrogen, responding to energy and environmental challenges. These efforts offer hope for a sustainable forklift industry.

In conclusion, the China forklift industry has demonstrated remarkable resilience even in the face of challenging times. While certain performance metrics experienced declines, it’s evident from the results that this industry remains extraordinarily stable and continues its path of robust growth.

With promising prospects on the horizon, particularly within automotive and artificial intelligence, we have every reason to anticipate that 2023 will usher in even greater achievements and milestones.

***It’s important to note that the data presented in this industrial report is sourced from reliable authorities, including CITA and the General Administration of Customs, ensuring its accuracy and credibility.

Other Reference: www.chinaforklift.com

This industrial report has been thoughtfully curated and written by ForkFocus, your trusted partner in industry insights and analysis.